Which way is silver headed in 2013? Silver prices since mid 2011 have been tightly clasped in a broad band between $37 on the upside and $26 on the downside. While the initial oscillations had been large, off late the movement without giving clues to direction is oscillating in a narrow range of $35- $29. While the price movement has been directionless, we thought that before undertaking an analysis of the fundamentals we should undertake a quick technical analysis of the spot silver prices to spot for clues of the likely future movement.

Silver Technicals not giving clues to market direction

Silver saddled between $29 and $33

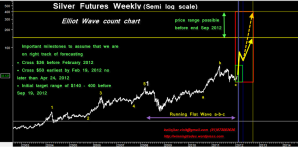

The downward sloping trend line from the recent $50 high was challenged at $35. At $35 silver made a 5th lower top and then retraced back below the $30 level. While the markets have reversed form there and moved up marginally, only a closing above $33 will be bullish for the stock. Once $33 is taken out then we would be watching the level of $35, which if Silver can surpass, then we would be in for a very explosive rally. However the move could take time and Jupiter in Taurus sign (sidereal) can be quite painful and the pain could last until May.

What is encouraging about the previous down move is that on a lower time scale silver has done a flat pattern formation (similar to gold) and taken support at the 61.8% retracement of the previous rally from $26 to $35. One eminent Technical Analyst, Alf Fields expects that the recent take down of the precious metals clearly indicates that the correction is almost over and prices should now start storming on their way up. [Link]

Caveat: If silver breaks $29 then the upside is under threat and then $26 would be our next support level. Until then we maintain our bullish bias.

Meanwhile Fundamental factor predict the tug war to continue

The global economic price drivers are virtually intact -.

- Silver Coin sales and ETF investment remains at an extremely high level

- Central Banks continue to be buyers of gold at all price points

- Asians continue to be big buyers of precious metals, gold and silver,.In particular China is rumoured to be a very aggressive buyer of Gold to augment its reserves. Once this is made “official” the prices of gold would only go through the roof and silver is expected to follow it in sentiment

- On the supply side, the underground reserves are good for only about 8 -10 years.

- New resource finds are trailing requirements

- Above ground reserves have virtually dried up. Its only time before the demand supply equation breaks up and the shortages loom to raise the prices of silver.

- The mindless printing of money by global Central Banks to counter the economic turmoil is almost certainly going to cause rapidly rising inflation; which is a big positive for precious metals.

- The recent fiscal cliff resolve is not expected to lead to any budget cuts and the Feds dollar for debt program is expected to lead to enhancing debt by nearly $ 4 tr.

Despite the relative bullish background for the long term price of silver certain events which have taken place in recent time could keep the lid on the price of silver.

- Majorly the recent dismissal by a federal judge of the class-action silver market-rigging lawsuit against J.P. Morgan Chase & Co. should encourage further short selling of silver.

- India, which is a major buyer of gold along with China, is expected to reign in gold imports through increasing duties and imposing restrictions on import quantities. These restrictions are being applied to shore up precious foreign exchange and curb the countries widening fiscal deficit. This could lower demand for gold and ease demand supply pressures and lower gold prices. This in turn would affect the price of silver as both are closely related.

- Demand for silver from the solar photovoltaic industry was much lower than anticipated in 2012. With increasing prices of silver, the solar cells industry cut back on the usage of solar paste leading to a fall in silver consumption to 40 mn oz from the previous year’s record breaking 60 mn oz. Although the solar cells industry is expected to grow at 10%, it remains to be seen how much the industry scales back on silver consumption. With no substitute for silver, it is not expected to decline much. However growth would be slower than anticipated previously.

Considering all the above we believe that prices would continue to remain directionless and hence Silver technicals should be the first indication for future price direction. We would be mildly bullish on the event prices break $33 on the upside and go short should $29 be violated on the downside decisively.

So where do you think the price of silver is headed ? Let us know what you think.

Before investing please make your own thorough analysis or speak to a qualified Certified Financial Planner / Advisor. Also read the disclaimer below.

Disclaimer: This blog is the personal blog of Vinit Bolinjkar. The views expressed in this article are entirely my own and do not reflect the views of my employer. This report is neither an offer nor a solicitation to purchase or sell securities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is accepted for errors of fact or opinion. Writers and contributors may be trading in or have positions in the securities mentioned in their articles. Neither http://winningtrades1.com or myself accepts any liability arising out of the above information/articles.

| Vinit Bolinjkar Head of Research, Ventura Securities Ltd | |

| Vinit Bolinjkar | |

| Winning Trades |

http://winningtrades1.com

http://in.linkedin.com/in/vinitbolinjkar

More interesting reading from Winning Trades

- Technical Outlook of the Indian Pharmaceutical Sector December 2012

- Wockhardt top pick in the Indian pharmaceutical space

- Burning Oil: Geopolitics of the war against Iran

- Gujarat Mineral Development Corporation – mineral resources stock to power your portfolio

- Four Principles of Stock Selection: Video interview of Kukkuji

- DEN networks – a multi bagger stock idea for India

- Silver price in preparation for a big rise