Silver may be setting up for a sharp price rise and though I did not report the recent spike, it is never unexpected. Though silver clearly is a low risk high yielding investment opportunity, before jumping to give a BUY call I would like to see silver close above the $29 level. This breakout has a target of $31, which is the next immediate resistance level. Once $31 is cleared then all over head resistance would have been taken out and would put Silver firmly in a bull grip.

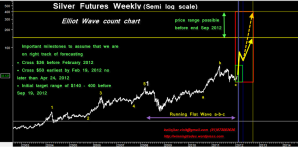

The following two charts for the long term and short term clearly enumerate our above stand.

COMEX inventory reduction favorable for bull case justifying low risk entry

Having examined the charts we now look for supporting evidence to examine the probable causes why silver would rally. Already the physical inventories at the exchanges are declining. Silver inventories during the sharp take down in the price of silver to $26 levels had seen inventories peak. Typically silver prices follow an inverse correlation to these inventories and hence declining inventories is a good sign for an up move.

Geopolitical risks affecting the already acute supply clearly spelling high gains on investments ahead albeit with low risk

Also on the supply side a lot of geo-political events are taking place which could be a set up for the the long term bull market. We already know that silver supplies mainly come from the the Latin American countries-mainly Peru and Mexico. Both these countries have been subject to violence amongst the miners and this could adversely affect supply lines in an already tight silver market.

Further resurgence of nationalization in these countries is also having an untold impact on the investment mood among global silver producers and they are now hesitant to invest in these countries given this uncertainty. Already Pan American Silver has suspended its investments in its flagship project Navidad due to these very fears. Bolivia another major silver mining country is also considering nationalization of one of the reportedly largest undeveloped silver deposits. Cumulatively these countries of Peru, Mexico, Argentina and Bolivia contribute almost 43% of the tiny silver market and can wreak havoc with supply lines.

This combined with the rising global political uncertainty, potential conflagration of the Iran war and the global debt situation creates for a potential gigantic spike in the price of silver. Further with the possibility of gold being included as a Tier 1 asset it is possible that the former glory of silver would also be restored in sentiment to the increased importance to gold.

Considering all the above it is very evident that there exists extremely low risk and high gain potential for investment in silver and one may consider buying physical silver with a technical break out above $ 31 and keeping a far stop of $26.

Related reading from Winning Trades

- Why silver is the best investment over the next decade

- Tiny silver to take on mighty gold

- Global OTC Derivates – Weapons of mass destruction (WMD) infographic

- Burning Oil: Geopolitics of the war against Iran

Related reading from around the web

- Silver Linings on the Horizon, says Upcoming Trading Forecast by… (prweb.com)

- Watch For Silver Prices To Breakout Higher (SLV, AGQ, ZSL, PSLV, SAC) (etfdailynews.com)

- Watch Out For A Silver Breakout Higher (safehaven.com)

- CFTC’s Bart Chilton Assures Silver Price Manipulation Probe Not Over (SLV, AGQ, PSLV, ZSL, GLD) (etfdailynews.com)

- Expect Major Silver Price Spike As COMEX Inventories Decline! (socioecohistory.wordpress.com)

- Lord Rothschild bets against the Euro/Silver advances above the resistance $28.50 (sgtreport.com)

- The Dumb Money Hates Silver; Why It’s Time To Go Long The Metal (AGQ, SLV, GLD, ZSL, PSLV) (etfdailynews.com)

- Silver Linings on the Horizon, says Upcoming Trading Forecast by Trading with James (prweb.com)

- Long-Term Technical Outlook for Gold and Silver (safehaven.com)

- Silver, Wine, Art and Gold (SWAG) To Protect From Inflation (zerohedge.com)

More interesting reading from Winning Trades

- Wockhardt top pick in the Indian pharmaceutical space

- Burning Oil: Geopolitics of the war against Iran

- Gujarat Mineral Development Corporation – mineral resources stock to power your portfolio

- Major correction in gold seen if price breaches $ 1500

Disclaimer: The views expressed in this article are entirely my own and do not reflect the views of my employer. This report is neither an offer nor a solicitation to purchase or sell securities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is accepted for errors of fact or opinion. Writers and contributors may be trading in or have positions in the securities mentioned in their articles. Neither http://winningtrades1.com or myself accepts any liability arising out of the above information/articles.

| Vinit Bolinjkar Head of Research, Ventura Securities Ltd | |

http://winningtrades1.com

http://in.linkedin.com/in/vinitbolinjkar

(function() {

var po = document.createElement(‘script’); po.type = ‘text/javascript’; po.async = true;

po.src = ‘https://apis.google.com/js/plusone.js’;

var s = document.getElementsByTagName(‘script’)[0]; s.parentNode.insertBefore(po, s);

})();

(function() {

var po = document.createElement(‘script’); po.type = ‘text/javascript’; po.async = true;

po.src = ‘https://apis.google.com/js/plusone.js’;

var s = document.getElementsByTagName(‘script’)[0]; s.parentNode.insertBefore(po, s);

})();