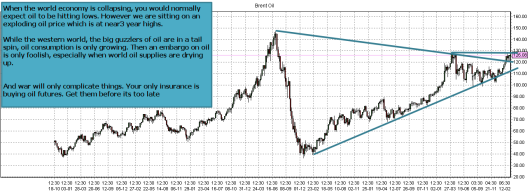

Oil is hitting new highs as Brent crude nears $126. And as the summer season approaches, the demand supply situation is only getting worse. The setup has always been around with the peak oil time in play

- and at any point the levee will break

However bad news can also provide opportunity and one can protect by following certain practical suggestion [link]. The crude oil chart below is clearly showing that the time frame is near at hand.

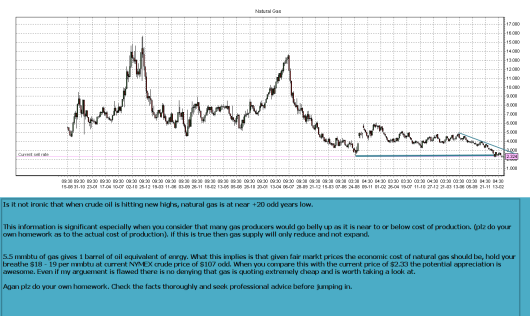

However natural gas, which is hitting new lows and is out of favor, presents an incredible opportunity. The self explanatory chart attached clearly outlines the

Disclaimer: The views expressed in this article are entirely my own and do not reflect the views of my employer. This report is neither an offer nor a solicitation to purchase or sell securities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is accepted for errors of fact or opinion. Writers and contributors may be trading in or have positions in the securities mentioned in their articles. Neither https://winningtrades1.wordpress.com or myself accepts any liability arising out of the above information/articles.

| Vinit Bolinjkar Head of Research, Ventura Securities Ltd

| Mobile: 0 9730836363

http://winingtrades1.wordpress.com |