Nifty Futures, post budget presentation of the Finance Minister experienced one of the biggest crashes in recent times. However to us this fall was not unexpected and if you had been reading our previous post we did expect the markets to come down to 5600 levels. After the huge fall all the perma-bulls have been frozen and bears are sniffing around having tasted fresh blood after many months. However, we have reason to believe that the markets may find support around the 5650 levels and this is going to be a very strong barrier for the bears to overcome before further bear hammering could be initiated.

Technical factors indicate strong support levels around the 5650 levels

If one were to take a look at the chart below its almost magical how the Nifty Futures fall was arrested at the confluence of a number of trend lines, technical patterns and fibonacci retracement levels. Of course this analysis is only in hindsight but the evidence of support is amazingly copy book style.

- Downward sloping Xx trendline

- Upward sloping trendline Yy

- The horizontal trend line C drawn from the previous top of 5700(not shown in chart)

- The parallel channel line MT

- 5848 is a 33% retracement of the entire rally from the 4700 levels 9again not shown in the chart)

- And the lower parallel (to the major thick black trendline) passing through T

- Head and shoulder target shown by the pink arrows

All these together have created a strong energy point around the lows and only if markets are able to sell off below these levels then a further fall would emanate.

Our proprietary short term oscillators are also indicating oversold conditions and the markets should put in a bounce or at least meander till Monday March 11, 2013 which is our energy cycle point for converting price to time. (Please note the vertical blue lines they were draw on the day of the fall and projected backwards in time to test the cycle and it has a margin of error of only 1 day for pin pointing the cycle high and lows !)

If the markets react upwards how will the trend unfold ?

So from all the above we can conclude that markets could recoil until the next energy date which is March 11. As long as the price stays within the channel and does not rally out of the N-O trend line, markets can safely be assumed to be in a downtrend. However if prices were to break this trend line then Nifty Futures has potential to travel to the parallel line drawn from P. Further price should also stay below the 50% retracement level which comes around 5850 levels. In case the rally has legs it could also travel all the way towards the 62% level of 5900.

We will explore this trend projection further in our future posts.

What if the markets were to continue the bear market without correcting upwards.

It is true that we are in a vicious downtrend and going by the price damage that we have seen in the broader market it is quite likely that further down side cannot be ruled out. In fact in one of our previous post we had maintained that prices could go as low as 5500 before end of February.

While our time target was not achieved we still believe, based on Elliot Wave Theory, a terminal impulse is in the offing and should retrace all the way below 5500 latest by March 6, 2013. This scenario is still open and on the break of 5650 we could experience a free fall to 5550 levels. This would mean two days of triple digit losses. Lets see how the next couple of days play out.

What is going to be our trading strategy on Nifty Futures

Since the overall trend is down, we would refrain from buying any calls. Our strategy in case the up move plays out is to write 5900 calls. In case markets break below 5650 then we would initiate a bear put spread by buying 5600 puts and writing 5500 puts.

The spread could be initiated in a staggered manner. So if the markets start selling off, buy the 5600 put and when , if you monitor intraday hourly charts, markets look oversold initiate the put writing for 5500.

Globally along with other BRIC nations, the Indian market was the ugly duckling with the most losses

Despite continued heavy buying by FIIs and successful completion of many IPOs, the broader market has suffered heavy losses and since February 13, 2013 Nifty Futures have fallen very sharply

Despite the heavy losses we continue to be one of the most expensive markets

Fundamental expectations fro the market also stand lowered post budget

Analyst consensus earnings estimates on Nifty have also been marginally lowered to 383 (earlier 380) and 435 (440) for CY13 and CY14 respectively.

The 1 Year Forward P/E chart shows that Nifty has a tendency to move from one band to another and the green band of 12.6 FY13 earnings would suggest a Nifty Futures price of 4825. While the number is difficult to digest, who would have thought in the begining of February, when the markets were at 6100 odd levels and bulls were cheering for 6500 – 7000 levels, that the markets would reverse on a dime. We at Winning Trades were the few who successfully forecasted this sell off. In fact we have further bear designs on the future of price of Nifty which we will explore through our blog posts. Stay tuned

What is your view on the market direction? Do you expect the sell off to continue or you expect consolidation around present levels? We would love to hear your opinion on the same.

If you enjoyed reading this post click this to tweet —–> Awesome blogpost!

For daily updates on our trading view on Nifty Futures & Options please send us an email at bolinjkar.vinit@gmail.com or SMS / WhatsApp on 9730836363. We would be more than happy to oblige our community of investors / traders.

Disclaimer: The opinions expressed here in are strictly for education purpose only. Before investing please make your own thorough analysis or speak to a qualified Certified Financial Planner / Advisor. We are not in any which way responsible for trading losses arising out of trading decisions taken based on the above.

This blog is the personal blog of Vinit Bolinjkar. The views expressed in this article are entirely my own and do not reflect the views of my employer. This report is neither an offer nor a solicitation to purchase or sell securities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is accepted for errors of fact or opinion. Writers and contributors may be trading in or have positions in the securities mentioned in their articles. Neither http://winningtrades1.com or myself accepts any liability arising out of the above information/articles.

| Vinit Bolinjkar Head of Research, Ventura Securities Ltd | |

| Vinit Bolinjkar | |

| Winning Trades |

http://winningtrades1.com http://in.linkedin.com/in/vinitbolinjkar

More interesting reading from Winning Trades

- Sun TV | Low Risk High Gain Stock to Power Your Portfolio

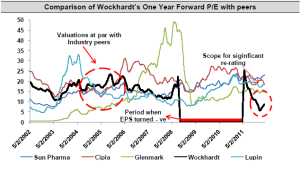

- Wockhardt top pick in the Indian pharmaceutical space

- Burning Oil: Geopolitics of the war against Iran

- Four Principles of Stock Selection: Video interview of Kukkuji

- DEN networks – a multi bagger stock idea for India

- Find Out Where Silver Prices are Headed in 2013

Related Articles

- Nifty slips below 5700; IT stocks gain (profit.ndtv.com)

Photo credit: Courier Mail