Prices will only flare up if the iranians are attacked

Oil prices have been on rampage for almost a month ever since the threat of Israel US aggression against Iran has been prevailing. And Brent Oil at $125 is nearing all time highs of $147 and threatens to explode to much higher levels. With the toned down stance of a press report stating that US agencies do not think that Iran is pursuing an active N weapons program and possibility of release of crude from the US and European strategic reserves, oil prices are expected to cool of a bit. However the aggressive posturing and military build up continues and is a precursor to higher oil prices should any untoward conflict emanate in the volatile region. In this article we try to understand the geo-politics of oil and the reactions of important stake holders in this so called curtain raiser to WW3

OIls not well

If Iran crude output is blacked out on the international markets then effectively 2.4 mbd of oil shortages would be created.

Paris based EIA has estimated that Saudi spare capacity is around 2.15 mbd which is effectively 75% of OPEC’s spare capacity. So Saudi Arabia is going to effectively be the swing producer of last resort. It should be noted that this spare capacity is yet to be tested and hence steep oil prices are virtually guaranteed.

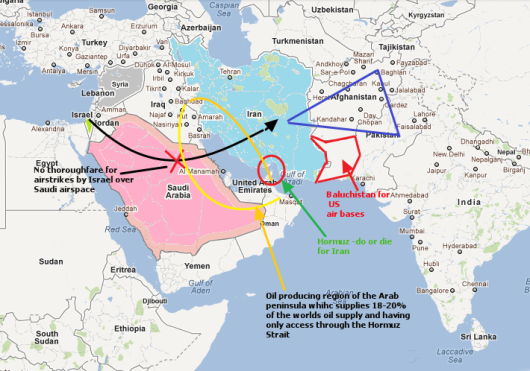

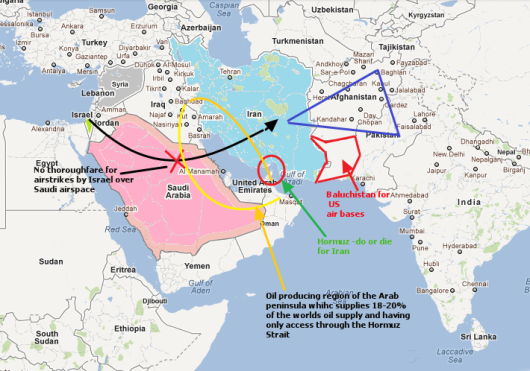

Strategic ownership of Hormuz Strait key to movement of oil

Hormuz - key to the battle

Almost 18-20% of total world oil supply passes through the Straight of Hormuz. And without exception most of the large OPEC players ply their trade through this Strait. So even if the entire Saudi spare capacity is put to use blocking of this Strait will still lead to supply shortages. Also though the Straight is 21 miles wide at its narrowest point, the width of the shipping lanes is only two miles in either direction (with an additional buffer of 2 miles). In addition, Iran has a huge coastline along the northern shore of the Persian gulf and borders the strait to the north and east, and it has a major naval base – and its key submarine base – close by. Hence it can launch an attack on any vessel passing through this Strait at any point in time raising the risk of travel of oil tankers within the area.

Iranian success at closure of Hormuz to be bullish for oil

As per Iranian navy chief Admiral Habibollah Sayyari, Iran has comprehensive control over the strategic waterway and that it would be “very easy” for his forces to shut down the choke point. Iranian navy has considerable asymmetric and other capabilities designed specifically to be used in an integrated way to conduct area denial operations in the Persian Gulf and the Strait of Hormuz. On the other hand the Americans believe that they can over power the Iranian attempts to close the Strait. But it would be a question of time and the implications from a global standpoint on the flow of energy would have ramifications probably beyond the military actions that would go on.

The ramifications from an oil point of view is that if Iran can blockade the Hormuz Strait for even 72 hours, prices can spike to $180-200 levels and in the case of a full blown skirmish crude oil can easily tear away to $300-400 if the Strait is blocked longer. Iran denied of oil exports, which is its only bread and butter, would put all its weight behind the strategy to close the Strait. The risk of conflict can deter oil vessels from wanting to travel into this zone further aggravating the situation.

Why Saudi Arabia wants the current Iranian regime to be vanquished

Post vanquishment of Sadaam, the rise of Shia majority Iran and the worlds second largest oil producer is viewed as a natural threat to the Sunni government of Saudi Arabia.  The Shiite majority in the oil rich northern regions of Saudi Arabia are feeling a sense of empowerment with the rise of Shiites in Iran and Lebanon, and this is viewed as a very cognizable internal threat by the King Abdullah dynasty to its political longevity. Further the radical clerical islamists of Iran are opposed to the present form of government in Saudi Arabia, since they believe that monarchies do not have any standing in Islam. Hence as per Wikileaks releases of November 2010, Saudi Arabian King Abdullah urged the US to attack Iran to destroy its nuclear weapons program, describing Iran as a snake whose head should be cut off without any procrastination. This also why other kingdom states support US action against Iran. Another issue of skirmish is that Saudi Arabia which has been an ally of the west for over 60 years would like to keep prices of oil low (for mutually beneficial reasons with the West), while Iran with its 80 mn population would like prices to rise in the short term to sustain its large economy.

The Shiite majority in the oil rich northern regions of Saudi Arabia are feeling a sense of empowerment with the rise of Shiites in Iran and Lebanon, and this is viewed as a very cognizable internal threat by the King Abdullah dynasty to its political longevity. Further the radical clerical islamists of Iran are opposed to the present form of government in Saudi Arabia, since they believe that monarchies do not have any standing in Islam. Hence as per Wikileaks releases of November 2010, Saudi Arabian King Abdullah urged the US to attack Iran to destroy its nuclear weapons program, describing Iran as a snake whose head should be cut off without any procrastination. This also why other kingdom states support US action against Iran. Another issue of skirmish is that Saudi Arabia which has been an ally of the west for over 60 years would like to keep prices of oil low (for mutually beneficial reasons with the West), while Iran with its 80 mn population would like prices to rise in the short term to sustain its large economy.

Israel the bogey man to beware of

While the US and Iran stare eye to eye, it is Israel that is the unrestrained force that could be the wild card. And in case they decide to strike out against Iran, the latter would retaliate by attacking oil facilities in the Gulf. It is at this point that the unpredictable elements of war would manifest and all hell would break loose. Surely the Iranians would attempt to block the Strait of Hormuz and this is when the US would be drawn into conflict as it would be forced to respond.

Although the Israeli’s believe that the sanctions will work to weaken the current regime (which is unpopular, both, internally in Iran and in the Arabs world), they fear it may not be soon enough to prevent Iran from taking their weapons program sufficiently underground, making it immune from any Israeli attack. Hence they favor an early military strike and ready to carry the sole responsibility.

However if it attacks on its own, Israel fears alienating the war tired US populace and upsetting the Obama military administration and damaging the long term advantages of the political goodwill. As a compromise stance they believe that an aerial strike which does not involve “American boots on Iranian soil’ is a solution that would be “grudgingly” acceptable to the American trinity of people, congress and the administration.

To air strike iran or not - a tough decision

However a direct attack on Iran is not that easy both in terms of execution and timing.

Israel gunning for these Iranian targets

But can the Israeli’s carry it out on their own? An Israeli attack would be a huge and highly complex operation and could involve as many as 100 aircraft, but it would probably be a one-shot deal. Further, Israel and Iran are separated by more than 1000 miles and hence an attack on Iranian installations would mean mid-air re-fueling for Israeli aircraft. While some jets could escape Iranian defenses on the “invasion phase”, it would be very difficult to negotiate the return trip as the chances of surviving Iranian military retaliation drops drastically and is akin to suicide bombing. On the timing of the attacks the best bet would be around the eve of the US presidential elections when nobody would raise any objections against Israel and Obama has a strong chance of a second innings.

It appears that ultimately the US would only have to pull off the attack

Hamas, Hezbollah and other Arab nations will respond against Israel

In case the Israelis are unable to pull this off, their plan B would be to keep up the pressure on the Americans, which in turn would launch the attack itself to see that it is done properly and there is no conflagration of retaliatory (Hamas and Hezbollah) forces due to Israel’s involvement. Another reason why the Americans might do it themselves is the reluctance of the Saudi Arabia to give permission to Israeli warplanes to use Saudi airspace as they would not be want to be seen as being on the same side of the “foe of the Arab world.” Further Saudi Arabia has hinted that they too would develop a nuclear weapons program to counter the Iranian threat, which is a precursor to the beginning of a nuclear arms race in an already volatile region. And this is something the American’s would want to avoid at all cost.

Contrary to UN inspectors reports, US intelligence says no plans by Iran to build the A-bomb

An article in the Times of India clearly states that 16 US intelligence agencies agree that Iran has long ago shelved its nuclear weapons program. So then why is the US and Israel so vehemently tom-tomming the fact that Iran is pursuing development of WMDs? It is indeed perplexing that a nation which buys no oil from Iran should go after it. Especially given the fact that the US economy today is precariously poised and rising oil would only hasten to accelarate the demise of its fragile economy.

One explanation offered by Vladimir Putin is that the US wants to promote its interests through regime change and hence the pretext of WMD.Will the Americans come clean on that, or is it a part of the larger ploy to enforce the NWO (New World Order).

The US bellicose posturing is indeed puzzling

Despite this the war build up continues. Yesterday the Pentagon requested for $100 mn from Congress to upgrade weaponry and beef up military presence in the Gulf. This is on top of the $200 mn provided last summer. Also US presence in the gulf is being stepped up with military personnel strength to be increased to 100k by early March (deployment of personnel to happen on two strategic islands Socotra, part of Yemeni archipelago and Omani island Masirah, at the southern exit to the Strait).

Who will take the Hormuz

The military build up will be bolstered further with the arrival of US aircraft carriers (Abraham Lincoln, Enterprise and Carl Vinson and their strike groups) and a french air craft carrier. Further another American aircraft carrier will be stationed in the Pacific and join the operations in case of an emergency.

Pakistan openly defiant against the American arm twisting.

As part of its greater strategy to encircle Iran, US wants more listening posts and air bases in Baluchistan province of Pakistan. A recent resolution introduced in the House of Representatives (blaming Pakistani security agencies for forceful disappearances and extra-judicial killings in Baluchistan) calling for the liberation of the country’s largest province is being seen as an arm twisting tactic of the Americans to coax Pakistan into acceding to its demand. In retaliation, Pakistan sponsored a trilateral summit between Iran, Afghanistan and Pakistan held earlier last week is seen as a “collective resistance to the American ambitions in the region.

Pakistan trapped between the devil and the deep blue sea

Pakistan, an energy starved nation, is pressing to complete the Iran Pakistan oil pipeline and has signed an oil for rice deal with Iran. So Pakistan renegading on this deal would be political suicide and hence openly opposes the US demand for an airbase. Political alienation of Pakistan from US would mean that Pakistan would bend more towards China, hurting its relations with Saudi Arabia and US its chief financiers. Further Pakistan also risks alienating the EU its largest trade partner to which it exports 22.6% of its produce. One thing is certain the choices that Pakistan makes is going to hurt it any which ways.

Neutral India most impacted by the Gulf crisis

With over 80% of India’s oil needs being imported, the bearings of the gulf crisis would have catastrophic consequences on India leading to a sharp slow down of its economic growth besides hurting its fiscal deficit. With over 12% of India’s oil imports coming from Iran, India has not recognized the US economic sanctions and continues to buy oil from Iran. However the political realignment of Pakistan away from the US and syncing with China has made India extremely uncomfortable. India has fought wars with both Pakistan and China over the past 50 years and is wary of both these nations with which it has border tensions on an ongoing basis. Additionally, India’s relations with the US and Israel have been on an ascendancy with Israel now India’s second largest military vendor and the US being the vital nuclear fuel supplier for its civilian nuclear program. Taking cognizance of this development India has gradually, and at the gentle persuasion of the Americans, started looking for alternate (Saudi) sources of oil. As late as last week one of its state refineries HPCL, has gone slow on sourcing oil from Iran while it has upped purchases from Saudi Arabia.

Russian and Chinese entry into the affair just makes this stalemate more interesting and bolsters Iran’s positioning.

Russia yesterday announced that any attack on Iran (or Syria) would be an act of aggression in its neighborhood and overtly stated that it would use military power if Iran is attacked. As former Russian Col-Gen said “A strike against Syria or Iran is an indirect strike against Russia and its interests. Russia would lose important positions and allies in the Arab world. Therefore, by defending Syria, Russia is defending its own interests.

In addition, Russia is thus defending the entire world from Fascism. Everybody should acknowledge that Fascism is making strides on our planet. What they did in Libya is nearly identical to what Hitler and his armies did against Poland and then Russia. Today, therefore, Russia is defending the entire world from Fascism.”.

The stance taken by Russia is indeed interesting as this will only add to the stalemate and increase tensions leading to a further hike in the oil price (which is very good for the Russian economy). Infact, as early as late November 2011, Medvedev warned of retaliatory action against Nato countries in case the US was to bomb Syria or Iran.

The Chinese made no bones of their inclination to aggression and they used veiled military counter approach as the answer to any attack on Iran. With deep economic relations with Iran, China has chosen to defend Iran even in case of WW3.

The threat of attack just united the Iranians

At present as the sanctions bite, the Iranian economy is in a state of collapse. Joblessness, declining incomes and inflation are rampant and the citizens are angry and rallying against the present tyrannical regime. However the patriotic feeling is at a new high and the Iranian political brinkmanship is using this to its best advantage by bringing its vast populace together using the threat of an attack on its sovereignty.

World burning without even a shot being fired

To further its propaganda, the Ahmadinejad regime has proclaimed to have stopped supply of oil to France and UK and has upped its ante on initiating preventive attacks against the western world and the OPEC oil facilities. It sees this as the best way to punish the already fragile western economies that have imposed economic sanctions against their nation.

Also with Iranian funds in Chinese Banks providing buying power and Turkish banks serving as a liaison with top EU nations (which are already negotiating with Iran for fuel), chances are that the sanctions would fall flat. But what is perplexing is why would the US attack a country from whom it does not source any oil. And even short of conflict, higher oil prices are already hurting fragile Europe, India and the world. For Iran this is a fiat accompli.

For the US and Israel rushing to war, before all other options have been exhausted, would be akin to replaying the mistakes carried out in the 2003 Iraq war of hyping the threat, exaggerating the benefits of war, and downplaying the risks and costs.