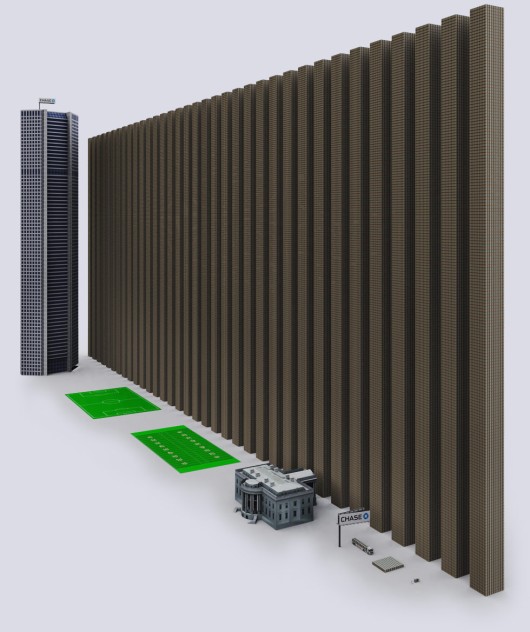

The time of global demise is not round the corner but waiting to burst over our heads like the heavens falling over you. Where are you Hercules when needed the most. 9 of the worlds largest banks have $228 trillion in exposure to OTC derivatives which are three times the size of the total global economy. Destruction is our destiny

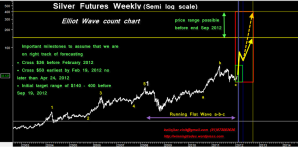

For greater detail click this link

Disclaimer: The views expressed in this article are entirely my own and do not reflect the views of my employer. This report is neither an offer nor a solicitation to purchase or sell securities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is accepted for errors of fact or opinion. Writers and contributors may be trading in or have positions in the securities mentioned in their articles. Neither https://winningtrades1.wordpress.com or myself accepts any liability arising out of the above information/articles.

| Vinit Bolinjkar Head of Research, Ventura Securities Ltd

| Mobile: 0 9730836363

http://winingtrades1.wordpress.com |