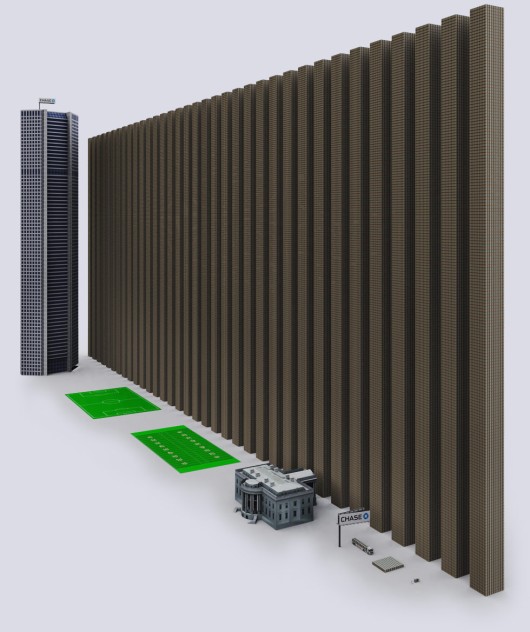

With the Central Banks already having added $6 tr in money printing, they are set to print for even more more years given the lackadaisical state of Euroland and US purchasing power which is threatening to blow off. Everyone is looking back to the U.S. Federal Reserve, European Central Bank , Bank of England and Bank of Japan to stabilize the situation once more. And more quantitative easing is definitely up for grabs as it gets back on the agenda for all their upcoming policy meetings. This provides us with low risk entry into the precious metals markets.

This clearly means that money printing is very positive for both gold and silver.

If you want to leverage off gold try silver

For the benefit of our readers I am going to start a new series of articles “Gold is Money”. I recommend to subscribe to the blog posts by clicking on the RSS feed at the top of the page on the left pane OR by subscribing to our follow blog by email again in the left pane. This we suggest as some of the articles could be 3000 words and you would enjoy reading them at leisure.

Also with the view that more readers benefit from this new series why not promote it on your social media networks and to other social bookmarking sites like stumbleupon, reddit, delicious, digg, diigo, newsvine, technorati etc which are given below. All you have to do is press the buttons and voila they go to all the sites and search engines. Thanks in advance for your support.

Finally we have added a FB fanpage https://www.facebook.com/WinningTrades/app_208412272531040 and we could surely do with a like.

Disclaimer: The views expressed in this article are entirely my own and do not reflect the views of my employer. This report is neither an offer nor a solicitation to purchase or sell securities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is accepted for errors of fact or opinion. Writers and contributors may be trading in or have positions in the securities mentioned in their articles. Neither http://winningtrades1.com or myself accepts any liability arising out of the above information/articles.

| Vinit Bolinjkar Head of Research, Ventura Securities Ltd

| Mobile: 0 9730836363

http://winningtrades1.com |