Ironically, Infosys which traditionally has overshot its own guidance has now for the last three quarters been struggling to meet its own forecast. With global budgetary allocations being cut and actual spending lagging these reduced allocations we believe that the entire IT industry is going to be under pressure. Infosys’ guidance on flat pricing and volume growth of 8-10% growth for FY13 was disappointing and we expect the stock to underperform going forward.

Also the FSI space which constitutes ~35% of Infosys’ business has been impacted due to delays in decision making and reduced IT spends due to more lenient regulation. Further, the macro economic situation in Europe (~30% of revenues) is also expected to deteriorate and affect discretionary IT spending and remains

a high risk. With the decision to hike salaries being deferred we expect attrition levels to increase, in case competition implements even moderate wage hikes. Margins (at 32.8% are down by 90 bps QoQ) could also come under pressure in case intense competition leads to pricing pressures.

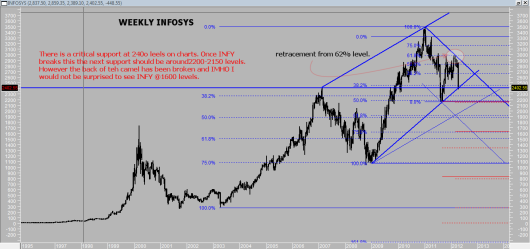

In the light of above mentioned facts we expect revenue and earnings to grow at a CAGR of 8.7% & 6.1% to Rs 39680 crore and Rs 9362 crore by FY14. In our opinion there is a further downside risk of 7% (Target price of Rs 2234 at 15x FY13 PE) over a period of 12 months. We recommend a SELL on the stock.

For a more detailed analysis and earnings expectation

Disclaimer: The views expressed in this article are entirely my own and do not reflect the views of my employer. This report is neither an offer nor a solicitation to purchase or sell securities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is accepted for errors of fact or opinion. Writers and contributors may be trading in or have positions in the securities mentioned in their articles. Neither https://winningtrades1.wordpress.com or myself accepts any liability arising out of the above information/articles.

| Vinit Bolinjkar Head of Research, Ventura Securities Ltd

| Mobile: 0 9730836363

http://winingtrades1.wordpress.com |