We initiate coverage on Mahindra & Mahindra Ltd (M&M) as a BUY with a Price Objective of Rs.975. At CMP of Rs.727, the stock is trading at 16.2x and 14.1x its estimated earnings for FY13 & FY14 respectively, representing a potential upside of ~34% over a period of 15 months. UV sales (XUV500 and Xylo) and LCVs (Maximmo, Genio and Gio) are expected to be the key drivers of growth, while the tractor business is expected to weather the cyclical downturn and experience moderate traction. In addition the tangible benefits of the Ssangyong acquisition would be felt over the medium term as the joint R&D efforts and new product launches materialize. We forecast revenues and earnings to grow at a CAGR of 15.6% and 10.7% to Rs.40,062.3 and Rs.3,169.7 crore, respectively over FY12-14.

Key Investment Highlights

1. XUV 500 and refurbished Xylo to sustain volume growth in the UV segment

2. Weathering the cyclical downturn in tractor sales

3. LCV growth momentum to continue

4. Ssangyong on the growth path; but profitability still a while away

For a detailed explanation please read the Ventura report on M & M Ltd.

Valuation

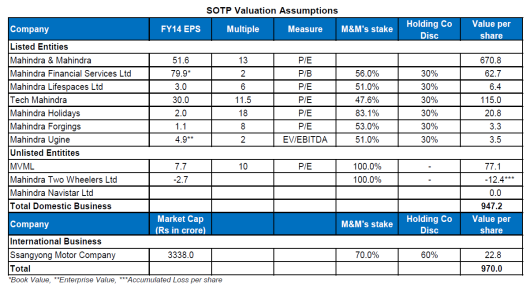

We have valued the standalone business at a P/E multiple of 13 on account of its leadership position in its core segments (Tractors and UV’s) while

the subsidiaries have been valued on their respective P/E multiples and we have assigned a 30% holding company discount. While we have valued the profitable unlisted arm of M&M i.e. Mahindra Vehicle Manufacturers Ltd at P/E multiple of 10, the other non profitable businesses have been valued as shown in the table below. Also, we have not valued the defence business and Mahindra Reva Electric Vehicles Ltd as these businesses are in their nascent stage, but could add significant value to the group in the future.

For a detailed explanation please read the Ventura report on M & M Ltd.

Disclaimer: The views expressed in this article are entirely my own and do not reflect the views of my employer. This report is neither an offer nor a solicitation to purchase or sell securities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is accepted for errors of fact or opinion. Writers and contributors may be trading in or have positions in the securities mentioned in their articles. Neither https://winningtrades1.wordpress.com or myself accepts any liability arising out of the above information/articles.

| Vinit Bolinjkar Head of Research, Ventura Securities Ltd

| Mobile: 0 9730836363

http://winingtrades1.wordpress.com |